Our Steve Young Realtor Diaries

Table of ContentsSteve Young Realtor Fundamentals ExplainedThe Single Strategy To Use For Steve Young RealtorThe Buzz on Steve Young RealtorSteve Young Realtor Things To Know Before You Get ThisSteve Young Realtor - An Overview

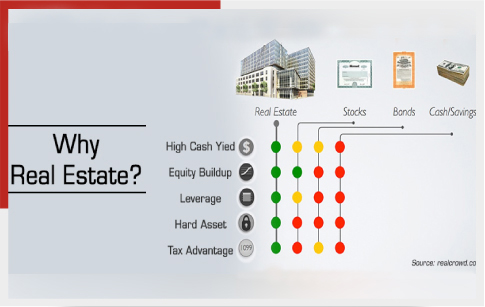

Property is usually a terrific investment alternative. It can create ongoing easy revenue as well as can be an excellent long-term financial investment if the value boosts gradually. You may even utilize it as a part of your total method to start developing riches. You need to make certain you are ready to start spending in real estate.Purchasing a residence, apartment complicated, or tract can be expensive. That's as well as the continuous upkeep costs you'll be accountable for, in addition to the possibility for revenue gaps if you are between lessees for a time. Right here's what you need to understand about spending in property and also if it's the appropriate option for you.

If you can not pay for to pay cash money for the residence, at the extremely least, you ought to have the ability to manage the home mortgage settlements, also without rental earnings. (Use our calculator listed below to aid you choose.) Think of it: With tenants, there can be high turnover. You might also experience a time where you have no tenants in all for the residential property.

Not known Details About Steve Young Realtor

And also, if you can't pay the mortgage, it might wind up damaging your credit scores, which will certainly cost you money in the lengthy run. Plan Out Every One Of Your Expenses When purchasing realty for investment purposes, you need to take into consideration the expense of tax obligations, energies, upkeep, as well as repairs. Usually, it is simpler to experience a rental firm as well as have them handle things like repairs and also rent out collection (steve young realtor).

Particularly if you do not have time to do every little thing that needs to be done at your home, using an agency is a great choice. You require to value your rental residential or commercial property to ensure that all of these charges as well as various other costs are fully covered. steve young realtor. In addition, you ought to take the very first few months of surplus cash as well as set it aside to cover the price of repair work on the residential or commercial property.

You should also be prepared to manage extra costs and other situations as they arise, perhaps with a sinking fund for the home. Research Study the Residential Property Meticulously If you are acquiring land that you plan to offer at a later day, you require to investigate the land deed extensively.

Be sure there isn't a lien on the residential property. You may also wish to consider points like the comparables in your area, including whether the area is up-and-coming, and various other outside elements that might influence the home worth. Once you have actually done your study, you must be able to make the appropriate decision concerning purchasing it as an investment.

Our Steve Young Realtor Diaries

You may make money on your investment, but you could shed cash. Points may change, and an area that you thought might boost in value might not actually go up, and also vice versa.

Instead, they have financial obligation securities, which are riskier. Crossbreed REITs combine equity and mortgage REITs. Just how do you purchase realty? You can take numerous paths to obtain begun in property. One would be to buy a multi-unit property as well as lease out the various other systems. You could additionally buy a single-family home to rent.

You can likewise lease rooms in your own residence to accumulate the funds to purchase more property. REITs additionally enable you to purchase property, however without needing to conserve up the cash to get a building or keep one.

The smart Trick of Steve Young Realtor That Nobody is Talking About

, short for genuine estate financial investment trust funds, is one of the easiest methods to spend in actual estate. With a REIT, you spend in genuine estate without having to worry about preserving or handling any kind of physical buildings.

When you acquire right into a REIT, you acquire a share of these residential properties. It's a bit like buying a common fund, just as opposed to stocks, a REIT take care of realty. You can make money from a REIT in you could check here two means: First, REITs make normal returns settlements to capitalists.

You can purchase a REIT equally as you would certainly purchase a supply: REITs are provided on the major supply exchanges. The National Association of Property Financial investment Trusts states that regarding 145 million U.S. locals are purchased REITs. Residential Properties Sinking your cash right into investment buildings can also prove lucrative, though it does call for some work.

The Steve Young Realtor Ideas

You can then either stay in the residential property or lease it out as you await it to appreciate in worth. If you rent the home, you might be able to utilize these month-to-month checks to cover all or component of your monthly home loan settlement. Once the residential or commercial property has actually appreciated enough in worth, you can market it for a big cash advance.

You can lower the odds of a poor investment by investigating local communities like it to discover those in which residence values have a tendency to climb. You must also collaborate with genuine estate representatives as well as various other experts who can you show historic gratitude numbers for the areas you are targeting. You will certainly have to be mindful of place.